- The Space Investor

- Posts

- 🚀 BlackSky To Reverse Split

🚀 BlackSky To Reverse Split

Plus Lynk Global delists from the Nasdaq, $ASTS mixed shelf offering, $PL and $SATX earnings, and more! The latest space investing news and updates.

The Space Scoop

Week Ended 09.06.2024

Happy Friday! With the first week of September in the books, not much has changed in SPAC world... BlackSky is reverse splitting and Lynx Global has delisted from the Nasdaq. Q2 earnings season has also officially closed out. Lets dive in.

Market Max-Q

Top Stories

1) Lynk Global ($SLAM) delists from the Nasdaq amid extension of SPAC termination date.

Last Monday, SLAM agreed to extend the SPAC termination date from August 31st to December 25th amid notice from the Nasdaq as the company was delisted last Tuesday and moved to OTC Markets.

Slam Corp “anticipated” the delisting and noted its ongoing business combination will be "materially unaffected" by the transition. "We look forward to seeing the company trading on the Nasdaq once again at the close of the transaction," said Ryan Bright, CFO of Slam.

Lynk Global and Slam Corp. SPAC announced plans to merge in December 2023. One might wonder what is taking so long? Is it market conditions for space SPACs or a lack of PIPE funding/expected high redemptions? Will Lynk even make it back to the Nasdaq by 2025? Time will tell.

2) BlackSky ($BKSY) announces a 1-for-8 reverse stock split.

In an expected move, BlackSky is joining other space SPACs in their right of passage: a reverse split. The stock has been hanging around $1.00 closely for the last 4-5 months, but the decision was approved by stockholders at annual meeting held on Wednesday.

Reminder: A reverse split does not change the number of common or preferred stock shares.

BKSY shares fell -20.5% on Thursday following the news and are expected to begin trading on an adjusted basis on Monday, September 9th.

3) Planet ($PL) and SatixFy ($SATX), the last reporters of space earnings season, closed us out of the Q2 earnings season (..excluding $SPIR $MNTS which are still in postponement mode).

In Other News

ATLAS Space Operations Raises $15M Growth Round

(Company)

The ground station services provider raised the pre-Series C funding for the working capital with a plan to to triple revenue over the next year. The round was led by NewSpace Capital and brings total venture funding raised to $50M since inception seven years ago.

Mesa Quantum Raises $3.7M Seed Round

(Payload)

The Colorado-based startup developing new gen quantum sensors expects their first prototype in 2026 and provide them to various customers in need of precise timing where GPS cannot go - space, underwater, conflict zones - to data centers. The round was led by J2 Ventures, with participation from SOSV.

AST SpaceMobile Provides Interim Update

$ASTS provided investors with some off-cycle information including the target launch date of September 12th for BlueBird satellites, expected warrant proceeds of $155M and pro-form cash & equivalents of +$440M (as of 6/30). The company also filed an updated $400M S-3 mixed shelf registration to update the prior version filed on June 2022 to provide itself with the flexibility to quickly transact in a variety of securities.

Chart of the Week

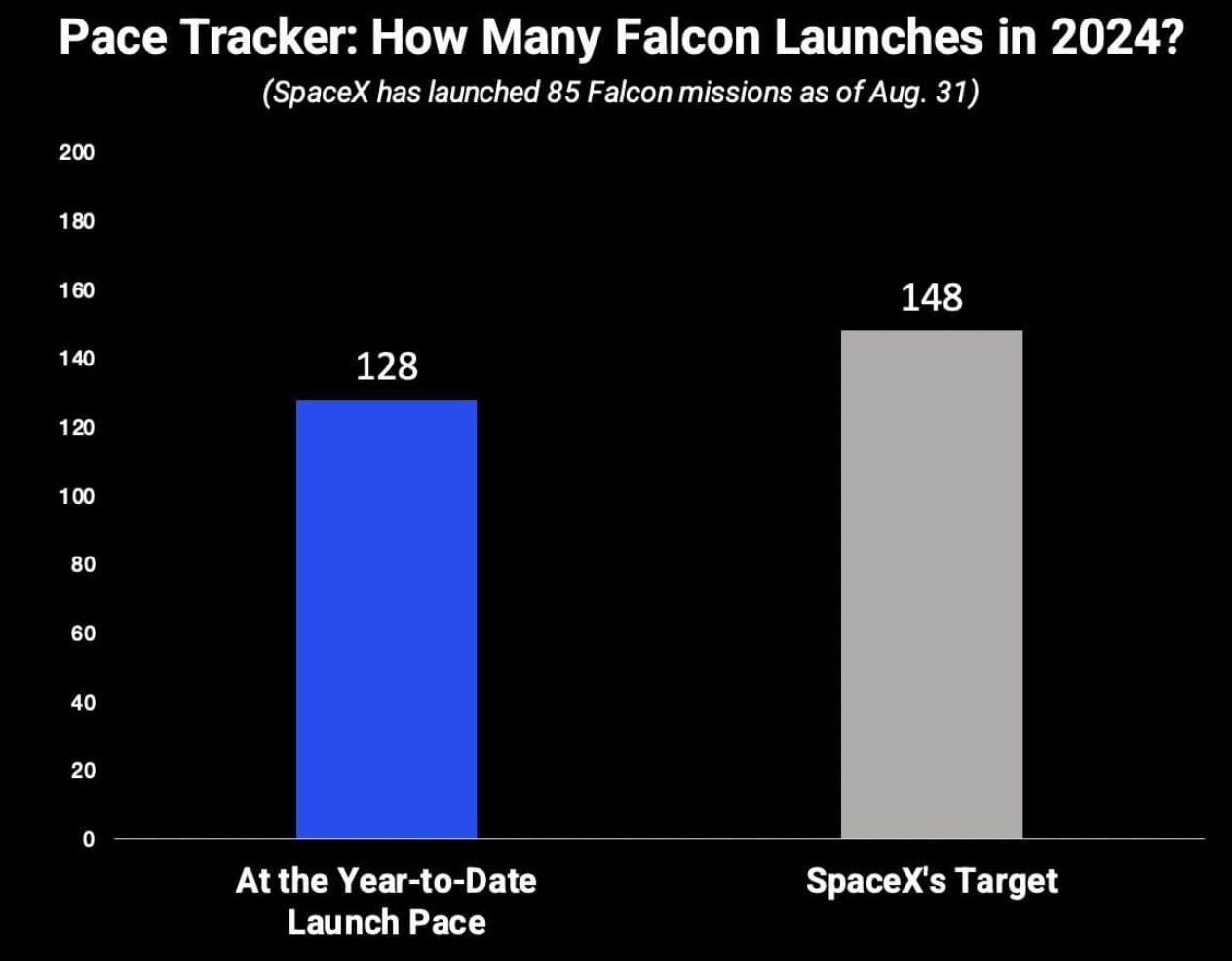

2024 SpaceX Falcon Launches: Target vs. Actual

(Source)

Links

• Redwire ($RDW) Completes Acquisition of Hera Systems• Sidus ($SIDU) Appoints Former Airbus US Space & Defense Executive Director to Its Board of Directors• Rocket Lab ($RKLB) Sets Sept 17th Launch Window for Second Dedicated Kinéis Mission• Redwire ($RDW) Joins the U.S.-U.A.E. Business Council• General Dynamics ($GD) Mission Systems Awarded $491.6M Design & Development Contract for SDA’s Ground, Management & Integration Program• Viasat ($VSAT) Awarded Potential $150M Blue Force Tracker Network Services Contract by DISA

Opinion

• SPAC Class of COVID-19: Where Are They Now?• India’s Space Ambitions Fuel Startup Fundraising Boom• Relativity Space Has Gone From Printing Money and Rockets to Doing What, Exactly?• EchoStar ($SATS): Dangerous Debt Comes With Massive Spectrum Potential• AST SpaceMobile ($ASTS): Commercialization Has Started• Intuitive Machines ($LUNR) Wins New Moon Landing Contract, but Stock Dilution Is a Huge Risk