- The Space Investor

- Posts

- 🚀 Lockheed To Acquire Terran Orbital

🚀 Lockheed To Acquire Terran Orbital

Plus Q2 earnings continue, Redwire's newest acquisition, $RKLB's new Wall Street price target, and more! The latest space investing news and updates.

The Space Scoop

Week Ended 08.16.2024

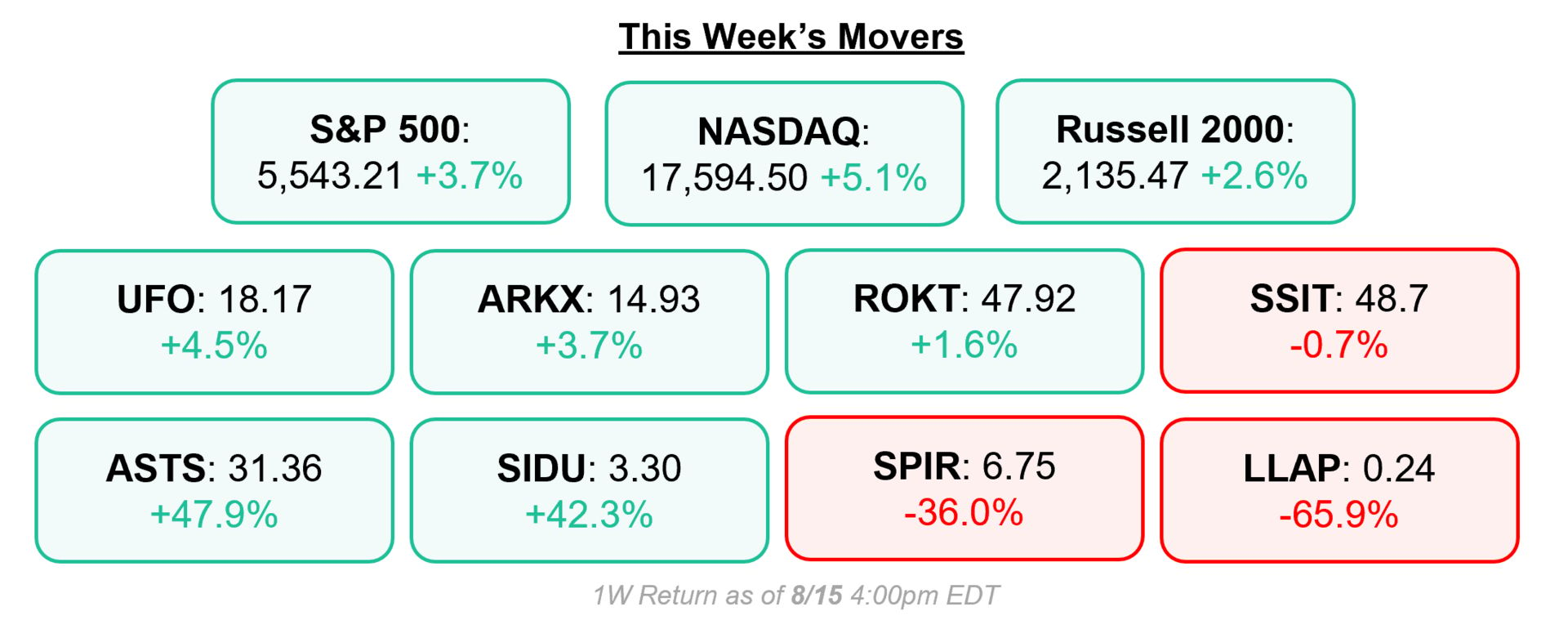

Happy Friday! What a week it was -- from earnings (and earning delays) to acquisitions to space stock surges. Lets get right to it.

Note: This newsletter is updated through Thursday 8/15, including stock performance listed. Pardon the interruption.

Market Max-Q

Top Stories

1) Q2 space earnings continued on, while the calendar is slimming down and nearing its end soon.

Cash & Equivalents: $31M, -57%

Revenue: $31M, -6% YoY

Net Loss: $(35)M vs. $(28)M

Adj. EBITDA: $(17)M vs. $(21)M

Backlog: $313M, -88%

Shares: -8.5%

Cash & Equivalents: $32M

Revenue: $41M, +130% YoY

Adj. EBITDA: $(26)M vs. $(12)M

Contracted Backlog: $213M

$5M Debt Paydown in Q2

Shares: -1.3%

Cash & Equivalents: $1.4B

Revenue: $152M, -15% YoY

Net Income: $129M, -75% YoY

Adj. EBITDA: $103M, -25% YoY

Backlog: $1.1B

Shares: +7.2%

Cash & Equivalents: $288M

Revenue: $900k vs. $0 YoY

OpEx: $64M, +10% YoY

Gross Capitalized Costs: $348M

Net Loss: $(73)M vs. $(18)M

Shares: +50.7%

Reasoning: "The Company is in the process of reviewing its accounting practices and procedures with respect to revenue recognition related to certain contracts in its 'Space as a Service' business."

Shares fell -33.6% on Thursday following the news.

2) Redwire ($RDW) to acquire Hera Systems for an undisclosed amount.

On Wednesday, Redwire announced the acquisition of the high-end spacecraft developer. The deal is focused on expanding Redwire's national security business and is now the tenth acquisition for the private equity backed SPAC.

Redwire will finance the acquisition with "balance sheet liquidity" and expects Hera to meaningfully add to future growth and profitability.

Due to the acquisition, Redwire is revising its FY 2024 revenue guidance up from $300M to $310M. The transaction is expected to close in Q3.

Shares finished +10.5% the next day.

3) Lockheed Martin ($LMT) to acquire Terran Orbital ($LLAP) for ~$450M.

After turning down a ~$600M valuation bid at $1.00 per share in March, Terran accepted an offer at a 25% discount on Thursday as things have quickly gone sour for the SPAC.

Earlier this week, LLAP posted its Q2 earnings without a press release and/or management call. The main takeaways were: 1) downsized backlog from $2.7B to $312.7M (aka throwing in the towel on Rivada hope) and 2) cash dwindling to $14.6M as of 7/31.

Lockheed currently represents ~71% of Terran's revenue through H1 2024 so this partnership-turned-acquisition makes sense. Lockheed will retire existing debt and the transaction is expected to close in Q4.

Lockheed Martin Ventures made its first investment in Terran in 2017, with two additional follow-on investments in 2020 and 2022.

Terran shares shares fell -39.4% on the news, down -65.9% for the week (through Thursday 8/15).

In Other News

Citi Raises Rocket Lab PT To $7

The Wall Street bank raised its price target from $5.45 and kept a 'Buy' rating on the stock following its Q2 earnings report. The new target "reflects the near-term cadence of the company's launches" and assigned a higher valuation multiple, citing the recent Archimedes hot fire test of the Neutron rocket "helps de-risk estimates."

Deep Blue Aerospace Raises Strategic Financing Round

The amount was not disclosed but follows a number of funding rounds completed this year by the Chinese rocket company. The funding will be used to focus core technologies and the commercialization of its Nebula reusable rockets. The round was led by Zhengyue Investment and Zhenghe Yunfan Fund.

Plan-S Eyes $400M Valuation in Funding Round

The EO IoT satellite and space technology firm is a unit of Turkey's Kontrolmatik Enerji Ve Muhendislik AS and plans to raise up to $40M in its funding debut. Proceeds will help fund R&D work and the expansion of the satellite fleet from 5 test models in LEO to 22 by July 2025 and over 200 by 2030. Plan-S is eyeing a Nasdaq 2027-2028 debut per the company's chairman.

Space VC Increases Size of its Second Fund

(Medium)

The venture capital firm run by prior founder turned investor Jonathan Lacoste has increased its recently announced Fund II to $22.5M. The new fund plans to expand into adjacent opportunities beyond space & defense tech like semiconductor, robotics, domestic manufacturing and more. The Space VC partners with founders at the Seed and Series A levels.

Chart of the Week

Terran Orbital's Decline: That's all she wrote for $LLAP as Lockheed Martin ($LMT) announced it would acquire the company on its second bid.. A later-comer to the 2021/22 space SPAC frenzy left it exiting the public markets down -98% from its $1.8B IPO valuation.

Links

• Rocket Lab ($RKLB) Successfully Completes 52nd Launch with Capella Space• Hughes ($SATS) Surpasses 5,000 ESA Terminals for OneWeb• Viasat ($VSAT) Stock Plunges After Investors Plan Big Sales• Sidus ($SIDU) Secures Contract with Xiomas Technologies To Supply FeatherEdge Computing System for Fire Detection• Planet ($PL) Satellite Data + AI Enables the Kingdom of Bahrain To Manage Smart Cities• Viasat ($VSAT) Announces the Next Evolution of L-Band Tactical Satellite Service (L-TAC)• Planet ($PL) To Launch First Hyperspectral Satellite, Tanager-1 and 36 SuperDoves• Momentus ($MNTS) Notifies SEC of Inability to File Q2 Earnings Report

Opinion

• Starliner’s Uncertain Future• Forget Boeing ($BA). Rocket Lab ($RKLB) Is Quietly Emerging as a SpaceX Competitor.• Dawn Aerospace’s Rocket-Propelled Aircraft Takes Flight• Rocket Labs’ ($RKLB) Growth Could Be Ready for Orbit• Spire ($SPIR): Sell on Accounting Issues & Debt Covenant Violations

Earnings Calendar

• $SIDU: Aug 19 - After Market Close• $PL: Sep 5 - After Market Close• $SPIR: TBD - Postponed

*Company confirmed dates only.