- The Space Investor

- Posts

- 🚀 Mynaric Cuts Revenue -70%

🚀 Mynaric Cuts Revenue -70%

Plus ULA rumors, Former Lockheed CFO joins $RKLB board, Astrocast delists following -99% move, and more! The latest space investing news and updates.

The Space Scoop

Week Ended 08.23.2024

Happy Friday! It was a quieter week compared to last and rather than spoil anything lets jump right in below and while we await the Polaris mission next week.

Market Max-Q

Top Stories

1) Q2 space earnings season is winding down despite a two stragglers that have yet to report (Spire / Momentus) and Planet, which is always last up. Highlights below:

• Cash & Equivalents: $1.4M • Revenue: $930k, -32% YoY • Gross Profit Margin: (91)% vs. 37% • Net Loss: $(4.1)M vs. $(3.5)M • Adj. EBITDA: $(3.2)M vs. $(2.8)M • Shares: -18.4%

Released revised FY 2024 forward looking financials and announced its CFO would step down

Revenue: €16-24M, down -70% from €50-70M, due to production delays of CONDOR Mk3

Cash & Equivalents: €6.3M, and the need to pursue additional capital sources to secure ongoing operations and production ramp

CFO voluntary departure for personal reasons

Shares: -52% on the news & -66% on the week

2) Astrocast ($ASTRO.OL) goes private and delists from the Euronext Growth Exchange in Oslo.

Following a direct listing IPO on August 25th, 2021, Astrocast has called it quits due to limited VC funding, near non-existent public funding and a sour -99% debut on public markets.

CEO Fabien Jordan provided an honest account of the situation on LinkedIn Wednesday, stating: "From a business maturity standpoint, it was too early to list the company as we were still in a pre-revenue phase, but it provided access to sorely needed capital. Once the initial excitement of the public listing wore off in 2022, being public made it more difficult to access fresh capital."

He continued: "Delisting the company was not easy and it was an uncharted path, but we found a way and we are now again able to raise funds from VCs."

3) Insert

Insert

In Other News

Starpath Raises $12M Seed

(Payload)

The startup focused on producing rocket propellant from raw materials on the Moon at commercial scale hopes to make fully reusable missions to the Moon and Mars possible. The round was led by 8VC and Fusion Fund, with participation from Day One Ventures, Balerion Space and Indicator Ventures.

AstroForge Raises $40M Series A

(Company)

The Asteroid mining startup will use the funding toward the company’s third mission on LUNR's IM-3 lunar lander in 2025 and attempt the first private landing on an asteroid. The round was led by Nova Threshold with participation from 776, Initialized, Caladan, Y Combinator, Uncorrelated Ventures and Jed McCaleb.

Insert

()

Insert

Chart of the Week

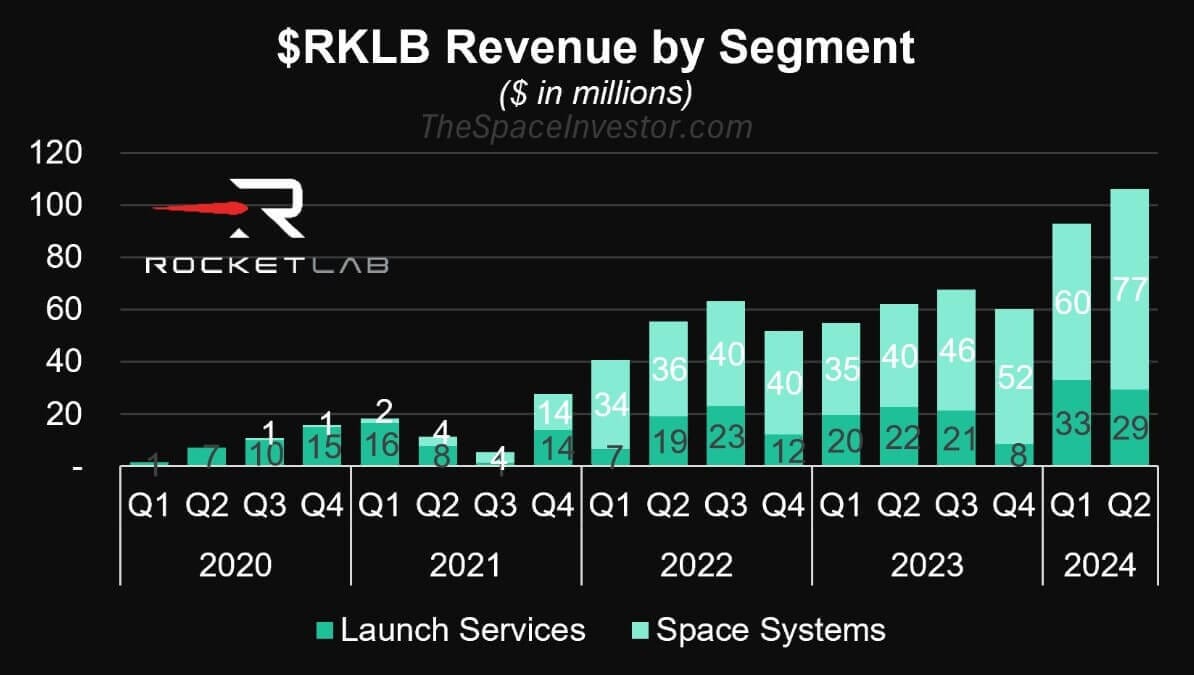

Rocket Lab Revenue Breakdown: In Q2 of 2020, launch services accounted for 100% of revenue. In Q2 of 2024, launch services only accounted for 27% while space systems now makes up 73% of total revenues. How the times have changed.

Links

• Boeing ($BA) and Lockheed Martin ($LMT) in Talks To Sell ULA to Sierra Space• Planet ($PL) Signs Contract With NATO Agency To Advance the Alliance Persistent Surveillance From Space Program• FCC Reauthorizes Globalstar’s ($GSAT) HIBLEO-4 Constellation• Sidus ($SIDU) Awarded $2M Contract for U.S. Navy Program• Iridium ($IRDM) CFO To Step Down in 2025• Liquid Intelligent Technologies and Globalstar ($GSAT) Partner To Deliver 5G Access Solutions Across Africa, Middle East and the Gulf• Former Lockheed Martin ($LMT) CFO Joins Rocket Lab’s ($RKLB) Board of Directors

Opinion

• Starlink – the Customer Perspective• Reusable Rockets – ARK Invest Big Ideas 2024• The New Moon Race: Assessing Chinese and US Strategies• AST SpaceMobile ($ASTS): Reaching Escape Velocity• Intuitive Machines ($LUNR): It’s Time To Buy

Earnings Calendar

• $PL: Sept 5 - Before Market Open• $SPIR: TBD - Postponed• $MNTS: TBD - Postponed

*Company confirmed dates only.