- The Space Investor

- Posts

- 🚀 Q2 2024 Space Earnings

🚀 Q2 2024 Space Earnings

Plus FCC approves $ASTS, $RKLB Archimedes hot fire, Anduril $1.5B Series F, Starlink analysis, and more! The latest space investing news and updates.

The Space Scoop

Week Ended 08.09.2024

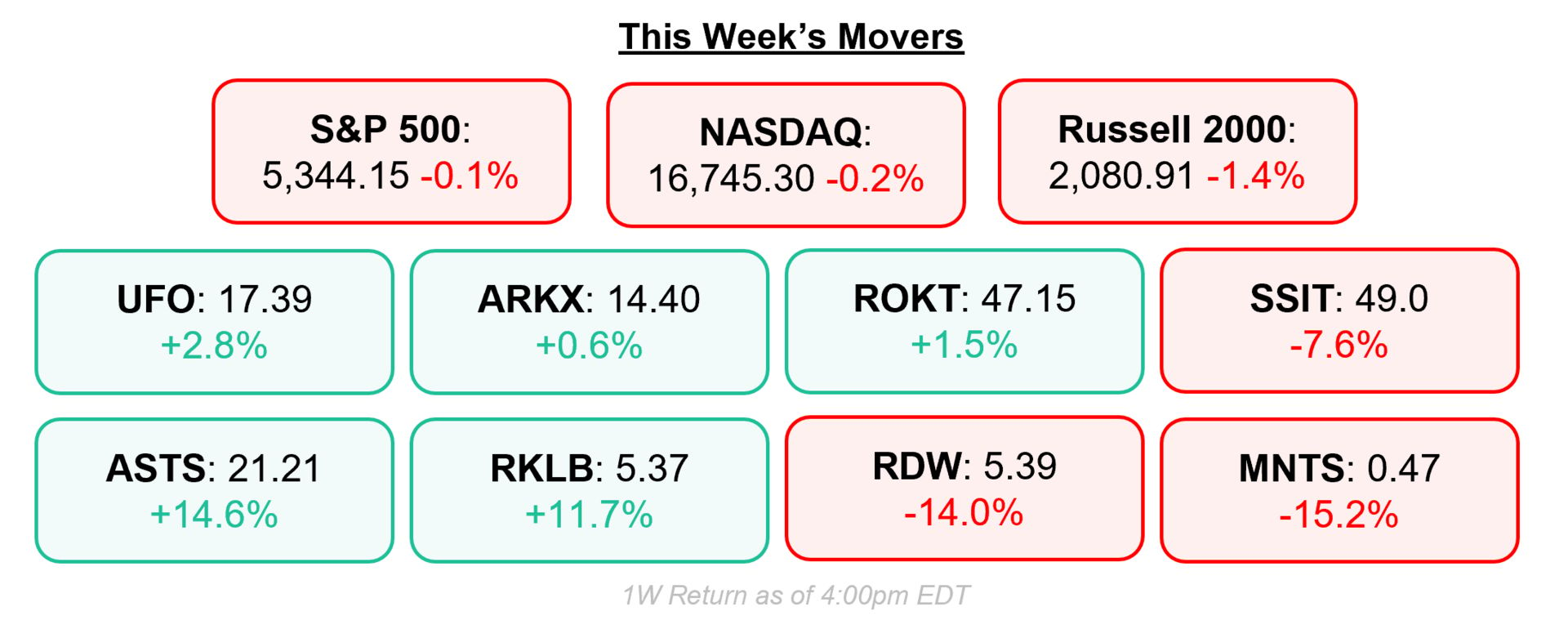

Happy Friday! What a week -- from markets to earnings to capital raises to continued Starliner questions, we have a long one for you today. Lets dive in.

Market Max-Q

Top Stories

1) Q2 Space Earnings season continued on with a jam-packed and wild week of 8 names reporting, 4 of which were SPACs. Highlights include:

Cash & Equivalents: $821M

Revenue: $4M, +125% YoY

Net Loss: $(94)M vs. $(134)M

Adj. EBITDA: $(79)M vs. $(116)M

FCF: $(114)M vs. $(135)M

Shares: +14%

Available Liquidity: $56M

Revenue: $78M, +30% YoY

Net Loss: $(18)M vs. $(6)M YoY

Adj. EBITDA: $2M, -63% YoY

FCF: $(11)M vs. $1M YoY

Backlog: $354M, +30% YoY

Shares: -10%

Revenue: $1B, +44% YoY

Net Loss: $(33)M vs. $(77)M

Adj. EBITDA: $404M, +120% YoY

Backlog: $3.6B, -5% YoY

Shares: +38%

Cash & Equivalents: $42M

Revenue: $25M, +29% YoY

Net Loss: $(9)M vs. $(33)M

Adj. EBITDA: $2M vs. $(6)M

Shares: +14%

Cash & Receivables: $463M

Revenue: $242M, +23% YoY

Net Income: $24M, +7% YoY

Adj. EBITDA: $49M, +21% YoY

Backlog: $4.6B, +318% YoY

Shares: +13%

Cash & Equivalents: $64M

Total Revenue: $61M, +10% YoY

Net Loss: $(10)M vs. $0.1M

Adj. EBITDA: $33M, +20% YoY

Shares: Flat

Cash & Equivalents: $497M

Revenue: $106M, +71% YoY

Net Loss: $(42)M vs. $(46)M

Adj. EBITDA: $(21)M vs. $(20)M

Archimedes Test Fire Complete

Shares: +13%

Cash & Equivalents: $521M

Revenue: $4B, -9% YoY

Net Income: $(206)M vs. $213M YoY

OIBDA: $442M, -29% YoY

Shares: -17%

In Other News

Anduril Raises $1.5B Series F

(Company)

Leading to a new $14B valuation, Anduril will hyperscale defense manufacturing by opening a 5 million+ sqft manufacturing facility. The round was co-led by Founders Fund and Sands Capital, with participation from new investors Fidelity, Counterpoint Global, and Baillie Gifford.

Muon Raises $56.7M Series B

The end-to-end space systems provider will use the financing to accelerate the buildout of the Halo Platform and scale its spectrum of deliverable capabilities. The round was led by Activate Capital, with participation by Acme Capital and existing investors Costanoa Ventures, Radical Ventures and Congruent Ventures.

Interstellar Technologies Raises ¥3.1B Series E

(Payload)

The Japanese rocket maker, aiming to be the first startup to reach orbit, will utilize the capital for rocket and smallsat development. The round was led by SBI and NTT Docomo.

Perceptive Space Raises $2.8M Pre-Seed

Emerging from stealth, the Toronto-based space startup is focused on developing a space-weather forecasting platform with AI. The oversubscribed round was led by Panache Ventures, Metaplanet, 7Percent Ventures, Mythos Ventures and AIN Ventures.

EtherealX Raises $5M Seed

The India-based focused on fully reusable medium-lift launch vehicles is designing its vehicles to get both the upper stage and booster back. The round was led by YourNest and included participation from BIG Capital, BlueHill Capital, Campus Fund, SGgrow and Golden Sparrow Ventures.

GalaxEye Raises $6.5M in Funding

The Indian-based space tech startup has announced the first close of its fundraising round, which will be used for launching its first satellite, ‘Drishti Mission’, and further developing its multi-sensor payload technology. The round was led by Mela Ventures and Speciale Invest, with participation from ideaForge.

Dcubed Raises €4.4M Series A

The in-space manufacturing supplier will use the capital to quadruple the production of satellite actuators. The oversubscribed round was led by Expansion and BayBG, with participation from HTGF, Aurelia Foundry, Ventis, Rymdkapital and Decisive Point Europe.

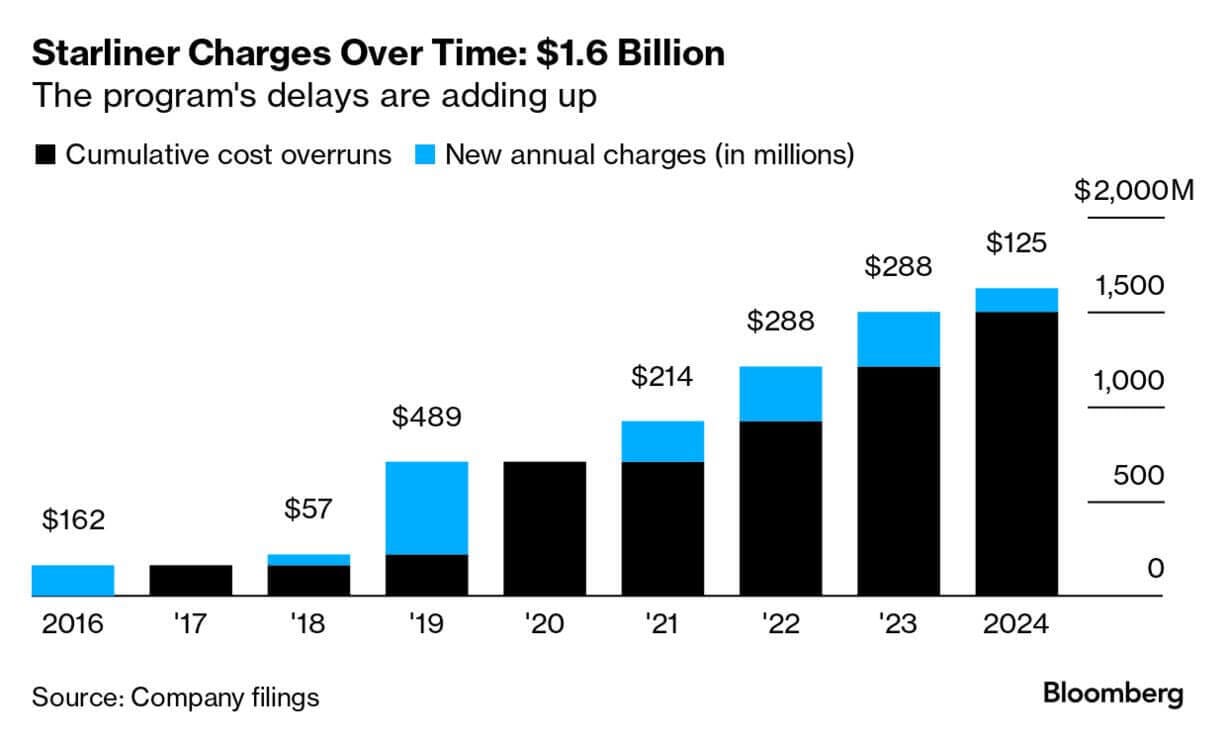

Chart of the Week

From an 8-day trip to two months to.. 2025? While Butch and Sunita remain stuck, Boeing's ($BA) woes continue on this year -- adding up all the charges reported related to Starliner since 2016 now totals more than $1.6 BILLION in losses.. Not great.

(Source)

Links

• SEOPS and Intuitive Machines ($LUNR) Partner To Provide New Lunar Rideshare Services• FCC Approves AST SpaceMobile ($ASTS) Launch of First Commercial Satellites• Voyager Space Selected by Lockheed Martin ($LMT) To Deliver Interceptor Upper Stage Subsystem Propulsion for Missile Defense Agency• Rocket Lab ($RKLB) Introduces Next-Generation Satellite Dispenser• Sidus ($SIDU) Develops Advanced High-Speed Switch Card Expanding Products• Rocket Lab ($RKLB) Schedules Next Electron Launch Eight Days After Prior Mission• Firefly Aerospace Announces Second Multi-Launch Agreement with L3Harris ($LHX) for 2027–2031• Rocket Lab ($RKLB) Partners with KSAT To Streamline SatComms• Rocket Lab ($RKLB) Begins Installation of Large Carbon Composite Rocket-Building Machine• AST SpaceMobile’s ($ASTS) Commercial Satellites Arrive at Cape Canaveral for Upcoming Launch

Opinion

• Starlink: Is This Time Different?• Y Combinator Bets on New Space Startups• Rocket Development Costs by Vehicle• A Deep Dive on Earth Observation Investments in H1 2024• 5 Considerations Ahead of AST SpaceMobile’s ($ASTS) Q2 Earnings• Why Viasat ($VSAT) Stock Soared After Posting First-Quarter Results

Earnings Calendar

• $LUNR: Aug 13 - Before Market Open• $TSAT: Aug 14 - Before Market Open• $ASTS: Aug 14 - After Market Close• $SPIR: Aug 14 - After Market Close• $PL: Sep 5 - After Market Close

*Company confirmed dates only.