- The Space Investor

- Posts

- 🚀 RKLB Closes GEOST Acquisition

🚀 RKLB Closes GEOST Acquisition

Plus remaining Q2 space earnings, $SPIR seeks new auditor, $LUNR $300M private offering, and more! The latest space investing news and updates.

The Space Scoop

Week Ended 08.15.2025

Happy Friday! We hope you all enjoyed SmallSat. Lets dive in.

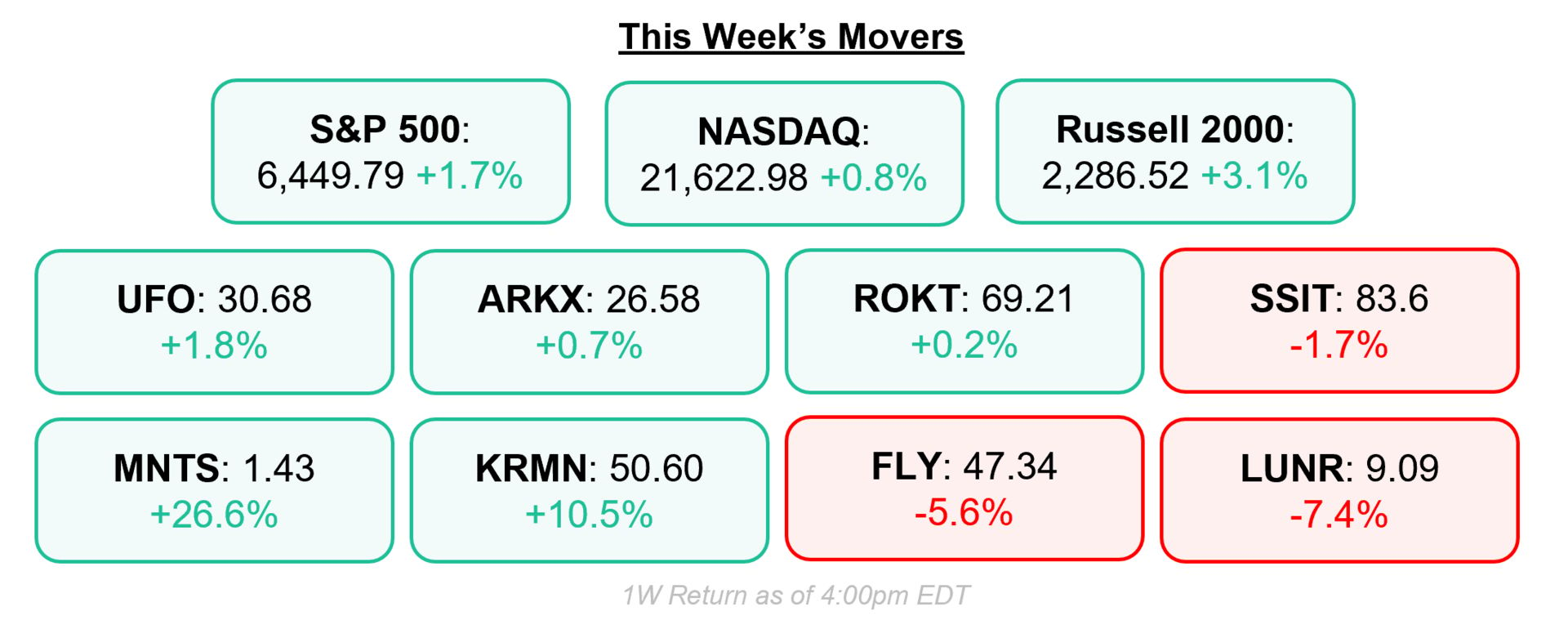

Market Max-Q

Top Stories

1) Second quarter earnings season just about came to a close this week, pending usual laggard Planet. Highlights below:

$ASTS

Cash & Equivalents: $939M

Revenue: $1.2M, +28% YoY

OpEx: $74M, +16% YoY

Gross Capitalized Costs: $907M

Net Loss: $(99)M vs. $(73)M

Shares: +8%

$SATL

Cash & Equivalents: $33M

Revenue: $4.4M, +27% YoY

Net Loss: $(7)M vs. $(18)M

Non-GAAP EBITDA: $(4)M vs. $(10)M

Shares: +4%

$SPIR (Preliminary)

Cash & Equivalents: $118M

Revenue: $18-19M

Issued RFPs to several registered public accounting firms and proposals by mid-to-late August 2025

Shares: -7%

$SIDU

Cash & Equivalents: $4M

Revenue: $1.3M, +36% YoY

Net Loss: $(6)M vs. $(4)M

Adj. EBITDA: $(4)M vs. $(3)M

Shares: -4%

In Other News

Edgx Raises €2.3M Seed Round (ST)The Belgian-startup focused on AI-powered edge computing for satellites will use the funding to accelerate the commercialization of EDGX Sterna. The funding round was co-led by the imec.istart future fund and the Flanders Future Tech Fund.Intuitive Machines Prices $300M Private Offering (CO)$LUNR's upsized offering of 2.5% convertible senior notes due 2030 were sold to "institutional buyers." $32M of net proceeds will pay for capped call transactions and the remaining for general corporate purposes, including operations, research and development and potential acquisitions.

Chart of the Week

Space IPOs Lag: Despite their initial IPO day excitement and price pops, space IPOs $VOYG and $FLY have had following week(s) of underperformance in an otherwise resilient market. Is this VC profit taking or premature businesses hitting the public markets? Neither? Let us know what you think.

Links

• Redwire ($RDW) Announces Release of Acorn 2.0 Software in Expansion of AI-Powered Digital Engineering Tools• Gilat ($GILT) Awarded Multi-Million Dollar Contract by Israel’s Ministry of Defense• Rocket Lab ($RKLB) Closes Acquisition of Geost, Expanding Its National Security Capabilities• BlackSky ($BKSY) Secures Two-Year Gen-3 Early Access Agreement With a New International Customer• Momentus ($MNTS) Secures NASA’s Flight Opportunities Program Contract To Study the Launch of Robotic Technologies• Momentus ($MNTS) Announces Warrant Inducement Transaction for $2.7M• Globalstar ($GSAT) Announces Multiple Recent Government Contract Awards and Strategic Partnerships Expected To Yield $60M

Opinion

• Rocket Lab ($RKLB): Still a Buy Post Q2 2025• AST SpaceMobile ($ASTS): Share Dilution Might Finally Be Over• Satellogic ($SATL): Facing Dilution Risk

Earnings Calendar

• $PL: Sep 8 - Before Market Open

*Company confirmed dates only.