- The Space Investor

- Posts

- 🚀 SpaceX Acquires Akoustis

🚀 SpaceX Acquires Akoustis

Plus continued Q1 earnings, $241M defense SPAC IPO, AE Industrial Partners $418M Fund II, and more! The latest space investing news and updates.

The Space Scoop

Week Ended 05.16.2025

Happy Friday! We have a long one for you today so lets dive right in.

Market Max-Q

Top Stories

1) Q1 earnings continued on this week with a heavy slate, which now takes us through the majority of the season. Highlights below:

Total Liquidity: $81M

Revenue: $62M, -30% YoY

Adj. EBITDA: $(2)M vs. $4M YoY

FCF: $(49)M vs. $1M YoY

Backlog: $291M, -2% YoY

Shares: -7%

Cash & Equivalents: $875M

Revenue: $718k, +43% YoY

OpEx: $64M, +14% YoY

Gross Capitalized Costs: $584M

Net Loss: $(46)M vs. $(20)M

Shares: -2%

Cash & Equivalents: $375M

Revenue: $63M, -15% YoY

Adj. EBITDA: $(7)M vs. $2M

FCF: $13M vs. $(8)M

Backlog: $272M, -17% YoY

Shares: +22%

Cash & Equivalents: $18M

Revenue: $3M, +2% YoY

Net Loss: $(33)M vs. $(15)M

Non-GAAP EBITDA: $(29)M vs. $(11)M

Shares: +2%

Cash & Equivalents: $36M

Revenue: $24M, -31% YoY

Net Loss: $(21)M vs. $(26)M

Adj. EBITDA: $(8) vs. $(1)M

FCF: $(17) vs. $(16)M

Shares: +13%

Cash & Equivalents: $567M

Revenue: $0.5M vs. $2M YoY

Net Loss: $(84)M vs. $(102)M

Adj. EBITDA: $(72)M vs. $(87)M

FCF: $(122)M vs. $(126)M

Shares: +51%

Cash & Equivalents: $12M

Revenue: $238k, -77% YoY

Net Loss: $(6)M vs. $(4)M

Adj. EBITDA: $(5)M vs. $(3)M

Shares: -11%

2) Perimeter Acquisition Corp. ($PMTRU) completes $241.5M SPAC initial public offering.

Remember SPACs? This week, Perimeter announced the closing of an upsized IPO of ~24.2 million units at $10.00. Concurrent with the closing, the Company also closed on a private placement of ~$6.4 million with identical terms.

Perimeter is managed by Jordan Blashek, co-founder and Managing Partner at America’s Frontier Fund, Joe Valdman, Managing Partner at Slate Hill Partners, and Todd Lemkin, former CIO at Canyon Capital Advisors.

The SPAC plans to "partner with exceptional companies at the forefront of America’s defense, national security and re-industrialization."

The units began trading on Nasdaq under the ticker symbol $PMTRU on May 13th and ordinary shares are expected to be listed under ticker symbol $PMTR.

In Other News

AE Industrial Raises $418M Fund II

(BW)

The private equity firm focused on aerospace, defense, and government services investments announced the close of its oversubscribed, second aerospace leasing fund from existing and new investors. Capital commitments were sourced from a mix of institutional investors, including public and private pensions, family offices, and endowments.

X-Bow Systems Closes $105M Series B

(PRN)

The maker of manufactured solid rocket motors and defense tech announced the final closing of its round, which was led by Lockheed Martin ($LMT). X-Bow and Lockheed also entered into a strategic agreement to accelerate X-Bow as an independent supplier of SRMs and other services to Lockheed's existing and future programs.

Zeno Power Raises $50M Series B

(Co)

The startup focused on developing nuclear batteries will use the capital to expand its team to 100+ and invest in its manufacturing capabilities to scale production. The round was led by Hanaco Ventures, with participation from Seraphim ($SSIT), Balerion Space Ventures, JAWS, Vanderbilt University, RiverPark Ventures, Stage 1 Ventures, 7i Capital and Beyond Earth Ventures.

SpaceX Acquires Akoustis for $30.2M

(BW)

Tune Holdings, a subsidiary of SpaceX, acquired substantially all of its assets of Akoustis Technologies, an integrated device manufacturer (IDM) of patented bulk acoustic wave (BAW) high-band RF filters for mobile and other wireless applications, for $30.2M via bankruptcy auction. This is SpaceX's third, rare acquisition following Swarm Technologies and Pioneer Aerospace.

Space Forge Raises £22.6M Series A

(ESF)

The Welsh in-space manufacturing startup will use the capital to develop its ForgeStar-2 platform and support its upcoming first in-orbit demonstration mission. The round was led by the NATO Investment Fund, with significant participation from the World Fund, the National Security Strategic Investment Fund, and the British Business Bank.

Reflect Orbital Raises $20M Series A

(PS)

The controversial sun-reflecting satellite constellation startup is planning its first launch in spring 2026 to illuminate 10 locations around the world. The round was led by Lux Capital, with participation from Seqouia Capital and Starship Ventures.

Solestial Raises $17M Series A

(PRN)

The space solar power startup plans to scale up manufacturing capacity of silicon photovoltaics to 1 megawatt per year with the capital. The round was led by AE Ventures, with participation from existing investors Crosscut Ventures, Zeon Ventures, and Mitsubishi Electric Corporation’s innovation fund.

OroraTech Secures £12M in Additional Funding

(SN)

The German-based startup focused on wildfire intelligence and risk assessment received additional Series B funding from BNP Paribas Solar Impulse Venture Fund. The latest funding will help deploy another 8 heat-tracking cubesats this year.

Adyton Raises $11M in Funding

(TD)

The military operations software startup, focused on turning pen and paper equipment tracking digital, recently secured a $7 million multi-year contract with US navy. The funding was led by Venrock, with participation from Khosla Ventures, Liquid 2 Ventures, Alumni Ventures, Initialized Capital, Kindred Ventures and Leblon Capital.

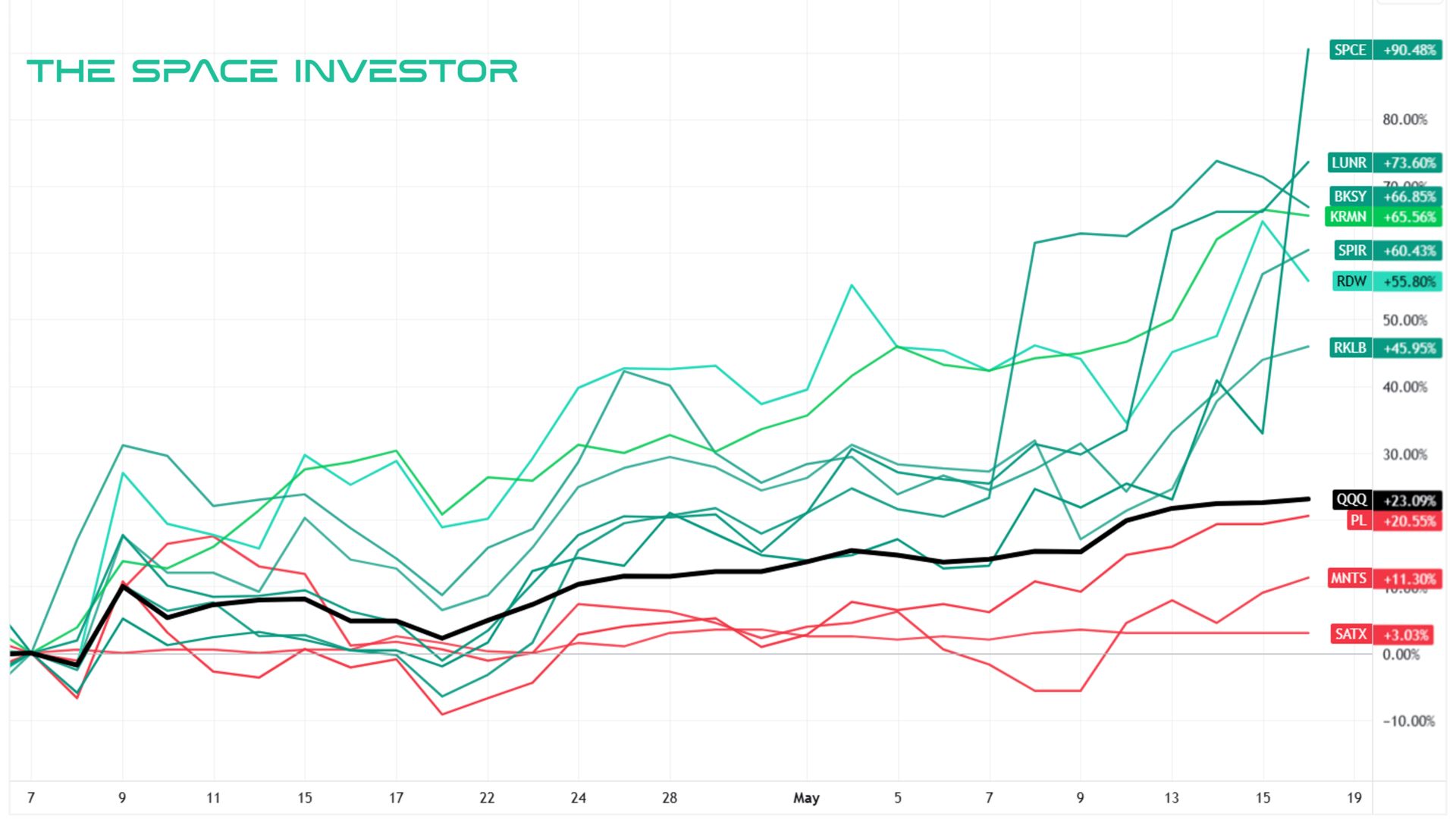

Chart of the Week

Space Stocks Since the Low: Since the U.S. market bottomed on April 7th, equities as a whole have ripped back relentless higher. Luckily for us, a large handful of space stocks are leading the way and outperforming the Nasdaq. These include:

Virgin Galactic ($SPCE) +91%

Intuitive Machines ($LUNR) +74%

BlackSky ($BKSY) +67%

Karman ($KRMN) +66%

Spire ($SPIR) +61%

Redwire ($RDW) +56%

Rocket Lab ($RKLB) +46%

What do you think -- Are the lows for 2025 in and behind us now?

Links

• Satellogic ($SATL) Secures Multi-Million Dollar Agreement with Asia Pacific Customer• BlackSky ($BKSY) Signs Multiple Early Access Agreements with International Defense Sector Customers for Gen-3 Services• Rocket Lab ($RKLB) Demonstrates Rapid Re-Entry Capability With Third Pioneer Spacecraft for Varda• Viasat ($VSAT) & Blue Origin To Partner on Launch Telemetry Demonstration for NASA Communications Services Project• Rocket Lab ($RKLB) To Launch NASA Astrophysics Science Aspera Mission To Study Galaxy Evolution• Sidus ($SIDU) Announces Successful On-Orbit Operation of FeatherEdge Aboard LizzieSat-3

Opinion

• What Happens Next if Congress Actually Cancels the SLS Rocket• Accelerating Investment in the Final Frontier: Leveraging Administrative Approvals• What’s Next for Rocket Lab ($RKLB) with Peter Beck and Adam Spice• BlackSky ($BKSY): Growing Backlog, Still Years From Profitability• AST SpaceMobile ($ASTS): High Expectations, Low Reality• Intuitive Machines ($LUNR): Success After Lunar Failure

Earnings Calendar

• $VSAT: May 20 - After Market Close• $PL: June 4 - After Market Close

*Company confirmed dates only.